All of us have had to do some level of estimating throughout our careers, especially when it comes to insurance technology projects. Whether you are implementing a new insurance product, new software, or a new core system, estimation has become one of the fundamental metrics used to measure budgets and workload. To that end, estimating is extremely important.

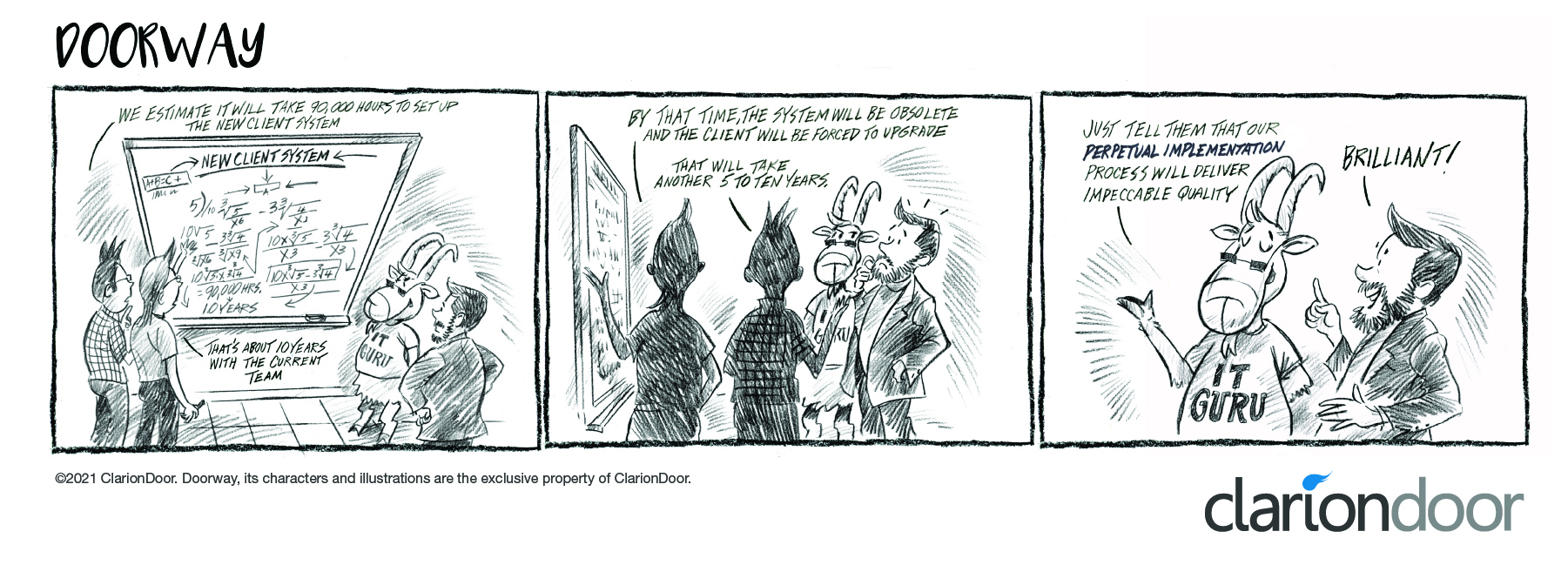

The problem is that many insurance technology projects are egregiously overestimated.

It may sound like an exaggeration, but there are many insurance solution providers in the marketplace that have actually estimated 90,000 hours or more to implement their solution. It is hard to even imagine 90,000 hours.

To put it in perspective, it takes about 14,000 hours for a round trip to Mars. You could make about 6 round trips to Mars in 90,000 hours. Let that sink in.

Unfortunately, this has become the norm for many solution providers and it raises several red flags:

1 The solution is too complex

Although solution providers make claims of configurability and flexibility, anytime an estimate is that high is an explicit indicator that the solution is neither. Most likely the solution is just too complex and difficult to implement, requiring extensive custom coding to make features work that should already be functional in the product.

2 Too much customization

Even if the solution provides configurability, oftentimes the client will get in the way with high demands for customization. Unless you are implementing an emerging line of business that has never been done before, it is arguable that customization is not needed. The differentiator for insurance companies is not in the customized features in their core system, but it is in their products.

3 The vendor has no clue

Sherman Kent, the father of intelligent analysis, once said that “estimation is what you do when you don’t know.” This is likely the more common scenario, but when a vendor proposes thousands of hours to implement their software, then the reality is that they honestly don’t know what it will take, especially for lines of business that they have previously implemented. The reality is that if the vendor has implemented their software for those lines of business before, then they should be efficient in their ability to deliver.

There are likely more red flags when hit with an out-of-this-world estimate; however, these are the initial ones that come to mind.

The ClarionDoor Experience

At ClarionDoor, not only do we use processes that actually get clients live, we bring clarity to our projects where the customer always knows what they are getting and when. By leveraging experiences gained from prior implementations, insurance knowledge, our unparalleled technology, and the experience of our team,

we are able to deliver our solutions faster than industry norms, enabling our customers to truly achieve speed to market.

We believe that insurance software needs to be flexible, configurable, and empower the customer to distribute products to market fast and seamlessly.

Learn more at clariondoor.com and follow us on Twitter and LinkedIn for the latest ClarionDoor updates.