One80 Intermediaries Launches Multi-Carrier Rating with ClarionDoor

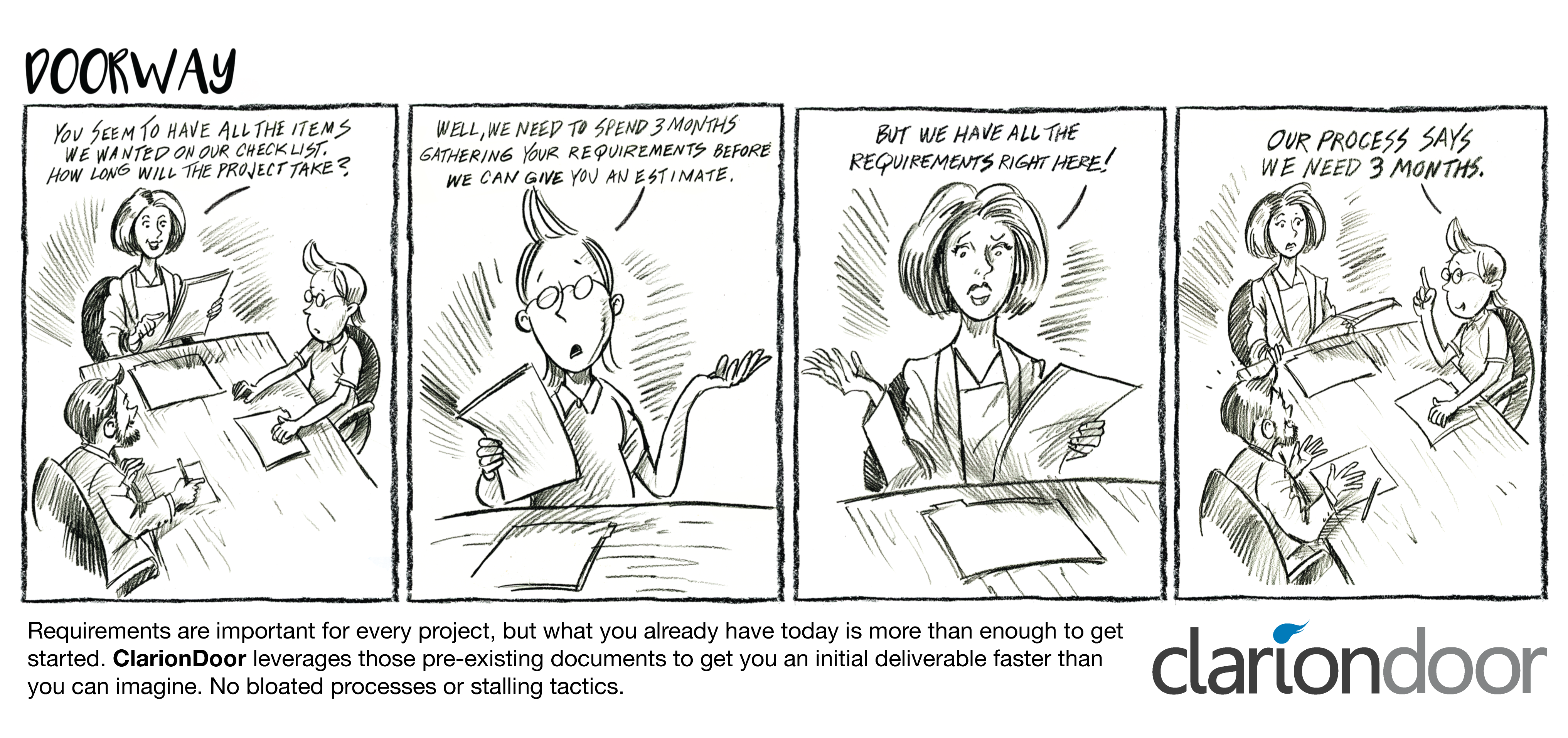

Santa Barbara, California — October 11, 2022 — ClarionDoor, a Zywave company, and provider of ultramodern insurance product distribution solutions, is pleased to announce a new partnership with Boston-based, One80 Intermediaries (One80) and their contract binding division at Access One80. One80, a wholesale brokerage, managing general agency (MGA), and program manager, is now live on ClarionDoor’s comparative rating and quoting solution.