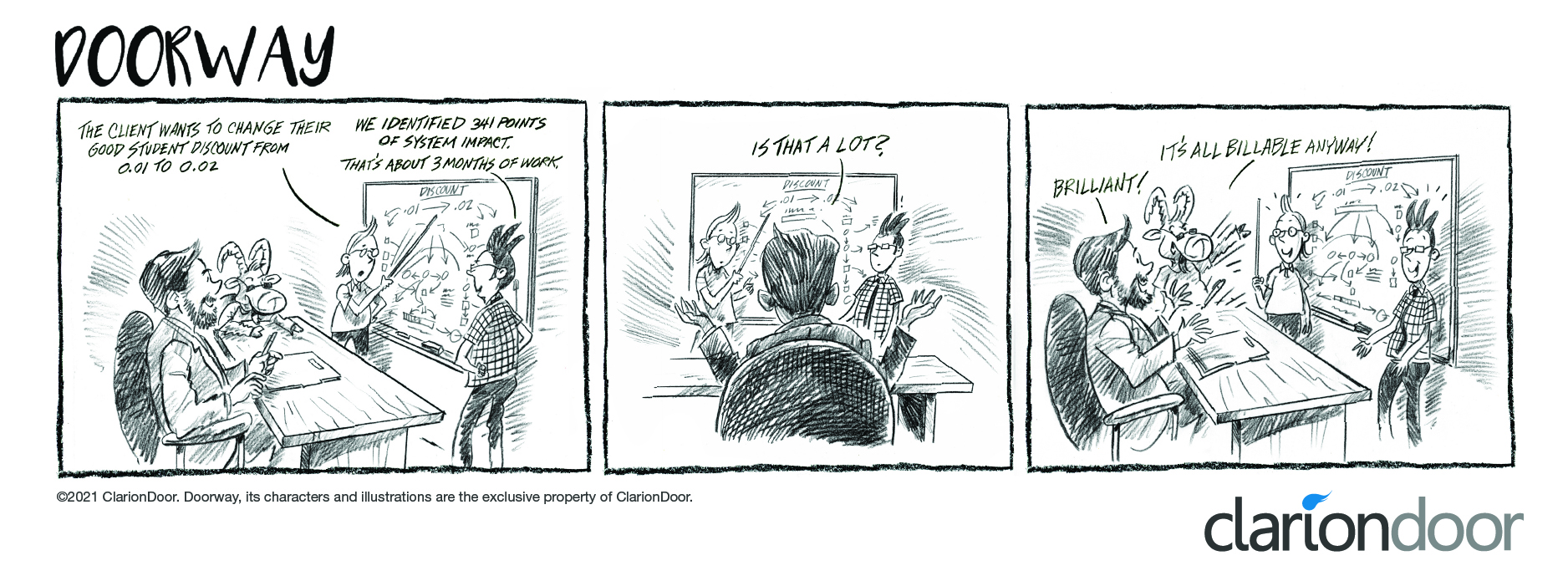

How you define your products and the speed to launch them are important for any insurer. Unfortunately, many experience the same frustrations shown in this month’s episode of Doorway – where even the most simplistic product change can become a nightmare. If this is your experience, then keep reading!

Not all product changes are simple, but if your rating system is outdated, then every product change becomes a nightmare. Changes that should take minutes end up taking days, weeks, even months – taking you longer to go to market, and making you less competitive.

There are many reasons why insurers struggle to maintain their product definitions. Here are our top 3 picks:

1 Technology

The technology you use directly impacts your ability to design innovative products, quickly go to market, and maintain your competitiveness. It is supposed to enable product innovation, but reality is that most technologies actually prevent it. If the rating system you use today is not cloud-native and built on an API architecture, then you will undoubtedly have challenges in keeping up with the competition.

2 User Interface

Managing your products is supposed to be simple, but the reality is that most rating engines have an overly complex user interface and processes. Typically, product definitions start with a model that is created in some other application like a modeling tool (SAS, R, etc.) or directly in Microsoft Excel. The problem is that many current rating engines are not able to accept or understand those models. Users need to re-architect the product definition in some proprietary language or syntax. This causes more effort and time to build out your products. It’s completely inefficient and slows your speed-to-market.

3 Integration

Having an externalized rating system is definitely on the right track, but one of the key factors in the flexibility and effectiveness of your system is how it integrates with other applications. We are really talking about APIs. Another problem with current rating systems is their ability to easily and seamlessly integrate. Unfortunately, too many rating systems require custom coding and extensive development to make that integration work, and that’s because they do not have APIs. Without APIs, everything becomes more complicated and prevents you from expanding the capabilities of your products.

These are just a few of the key reasons we identified into why insurers struggle so much with their current rating systems. There are definitely more. However, not all hope is lost because there is a better way! It’s the ClarionDoor Way!

The ClarionDoor Experience

ClarionDoor’s first product launch was a rating engine. We understood the importance of rating and being able to develop innovative insurance products and saw a significant deficiency in the current rating engines. But, we didn’t just build another status quo engine. Instead, we built something that was innovative, flexible, configurable, and would position insurers to be futureproof.

ClarionDoor’s CD Rating was designed to not only revolutionize rating, but entirely change the product definition experience. Built on a cloud-native, API-first architecture, and hosted exclusively on AWS, we introduced a new approach to rating that had never been done before.

Want to learn more about CD Rating? Contact us at [email protected].

Follow us to stay updated with ClarionDoor.