By: Spiro Skias

For the first time in insurance history, technology has become a competitive driver for just about everything from consumer demand to emerging markets. However, insurance companies still struggle to adopt new technology fast enough – and the problem is Moore’s Law.

On April 6, 2022, Michael DeGusta, general manager at ClarionDoor, will be discussing this topic in more detail in a session hosted by Carrier Management titled “How to Future-Proof Yourself in an Industry of Constant Change.” Reserve your seat today!

Webinar Preview

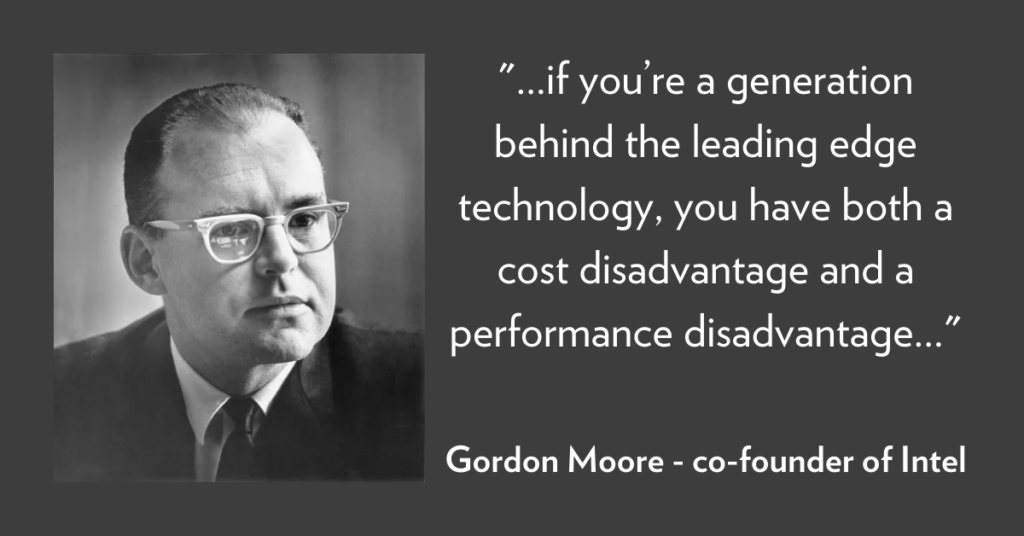

In 1965, an engineer by the name of Gordon Moore predicted that computing power would double every two years, and that the cost of computing would reduce by 50% over that same period of time. We are living through this exact scenario today and it is one of the major challenges with insurance technology.

“when computing power doubles every two years, technology initiatives need to take a fraction of that time to be effective”

Spiro Skias – Director of Product Marketing at ClarionDoor

Many insurers were convinced that spending 5 to 10 years on a digital transformation initiative was acceptable and at the end, would provide some sort of competitive advantage. What many are realizing is quite the opposite. Instead of gaining an advantage, they find themselves needing to upgrade what they just installed.

40 years ago, nobody cared about what technology insurers were using, mostly because the focus was always on the back office and processing efficiency. It was never about the consumer. Today is obviously different. We have more computing power, broader consumer reach, and more data than we could ever imagine.

It’s time for insurers and vendors to rethink their technology approach. Rather than act tactfully, plan and implement strategically to better position yourself to be future-proof.