Many date the beginnings of the insurance industry’s digital transformation to the emergence of cloud computing some 15 years ago. Others go back further, to the arrival of the commercial version of the internet in the mid-1990s. Some would trace the origins all the way back to the debut of personal desktop computers in the early 1980s or even to the introduction of digital calculators in the 1970s.

Whatever date is correct, it’s clear that digital transformation in insurance has been underway for a very long time. So, why haven’t we moved on? Why are we still focused on digital transformation?

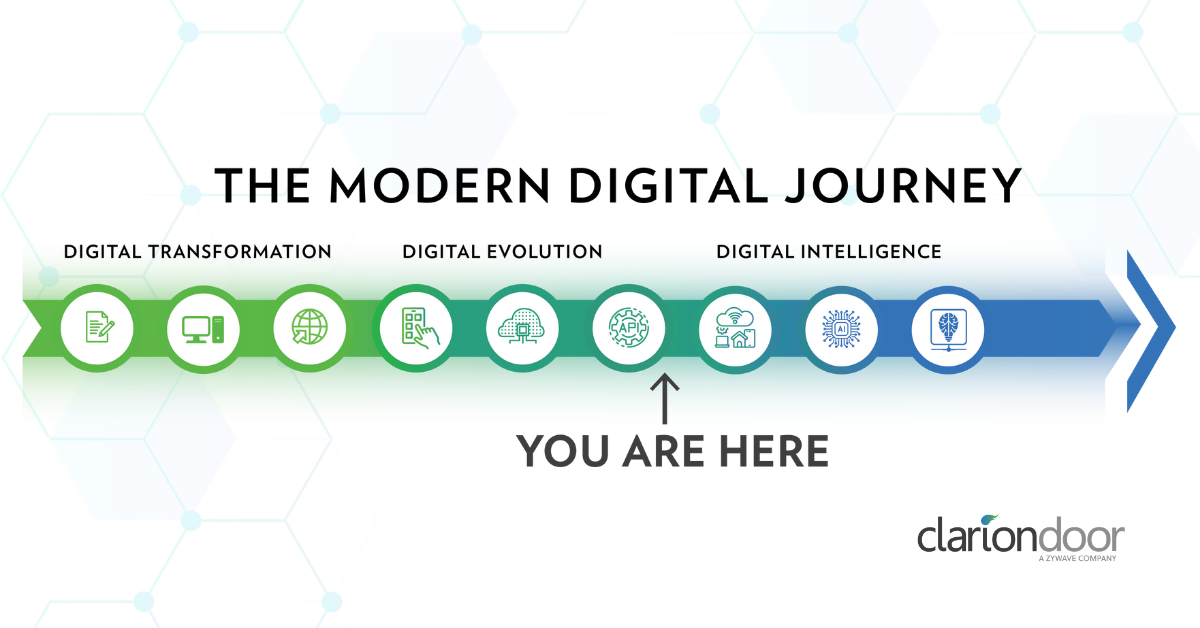

In fact, it’s time we wind down the digital transformation phase and move to the next stage of digital strategy, which we call digital evolution, and then to the third stage: digital intelligence. But the ill-defined transformation process is just one part of a digital strategy. To get the full benefits of digital technology, you need to understand and define all the steps that will get you there. Here is what the full journey looks like:

Digital Transformation

One of the greatest problems with digital transformation is the fact that it’s poorly defined. There really is no widely accepted definition of what digital transformation means; however, many in the industry claim otherwise. Without a formal definition or understanding of what digital transformation is, people use the term in very different ways. For some, digital transformation means ripping and replacing your core systems. For others, it can mean process automation.

A workable definition is that digital transformation is the transition from manual, non-digital formats and processes to digital. For example, a company goes from handwriting quote indications to using software to process and manage them. Or moving from manual rating processes to using a core rating engine.

Either way, the real impetus behind digital transformation was always about operational efficiency. Insurers needed to scale operationally with the market and legacy approaches just don’t work. There is no doubt that digital transformation was a necessity.

Unfortunately, most of the activities under the umbrella of digital transformation are not transformative at all. They are merely incremental. And, while transformation is routinely described as a journey, the end is never in sight. Without a definitive finish line, or with the finish line constantly moving, it is near impossible to establish meaningful goals and measure return on investment (ROI).

Arguably, over 99% of the insurance industry has already transformed digitally. Even if you are manually rating risks in Excel, especially for smaller or specialty lines of business, you are still using a form of digital technology to do that. (Now, if anyone is still using Excel, slide rules, or handwriting indications on paper, please email me. I’d love to chat.)

Digital Evolution

The next phase is really evolving current digital systems to modern technologies, such as the cloud and application programming interfaces (APIs). A common example of evolution is replacement of core systems or applications. Whether you are replacing an entire ecosystem or just components, like rating and pricing, you have moved beyond transformation and into the evolution phase.

This phase has been marked by the influx of insurtechs that have disrupted the industry with a technology-first approach built on a backbone of cloud computing and API architectures, like ClarionDoor. This influx exemplifies how the industry is evolving with technology and is forcing insurers to rethink their digital strategies. The days of on-premise server rooms and massive IT teams to manage software are long gone, evolving into a touchless environment that leverages best-of-breed technologies.

Driving this evolution is the desire for faster speed to market, seamless integration, operational efficiency, an improved customer experience and a comprehensive platform for product distribution. Insurers are recognizing that they can get to market faster and cheaper with modern technologies than they could with traditional insurance software.

It used to take up to 20, sometimes 30, minutes to get a basic personal lines quote online. Today, a quote can be generated in just a few seconds, based on only a couple of data points. This epitomizes the meaning of digital evolution — continuous improvement through innovation.

Digital Intelligence

Digital intelligence is mostly referred to as a human interaction with the digital world. However, from a system perspective, intelligence takes on a whole different dimension and meaning. This is the phase where artificial intelligence (AI) and machine learning live and involves a new level of thinking in how insurance software should work.

In today’s world, every insurance product is based on a finite model derived from historical data. Many organizations have tried to adopt machine learning techniques to develop predictive models; however, the result is still static. In other words, the “prediction” cannot change unless another model is created. For a true digital intelligent system, it needs to be self-adapting, self-correcting, and self-aware (I know the last one sounds scary).

Until now, the insurance industry has embraced digital intelligence as being synonymous with automated chatbots, but it is obviously much more than that. It should be about constantly looping real-time data into the modeling process and enabling the system to adjust and adapt accordingly.

The industry was fairly close to this approach with usage-based insurance (UBI). UBI was based on the idea of adjusting premiums based on user behavior. If you drive safely or exercise every day, your premium would go down. It required a method of tracking a person’s behavior either through a device on your smartphone, vehicle, or wearable device.

The biggest problem with UBI was that insurers focused on changing the behavior of the individual instead of having the system learn those behaviors. Although it was intended to be adjustable and adaptable, the UBI model was static. It was an incentive-based approach to adjusting premiums.

If we want to move towards true digitally intelligent insurance and an even more hyper-personalized experience, AI systems need to learn individual behaviors with a constant loop of real-time data. Future applications will go much further, automatically adjusting rates, coverages, limits and deductibles. The reality is that although we are all similar in nature, we are all different and don’t always fit into the insurance modeling demographics. AI is definitely the path towards achieving a more personalized insurance experience, but there is still quite a ways to go on that journey.

Conclusion

The intent around digital transformation is noble and necessary, but it is not the entire journey, and the insurance industry must start to recognize that. Once we can all agree that transformation is just the initial step in the journey, we can have more educated conversations on how to elevate insurance technology to the next level.

Currently, the insurance industry is in the mid-to-late stages of digital evolution and on the cusp of digital intelligence. As technology continues to advance, we will likely be in the evolution phase for another decade and the intelligence phase for quite some time after that.

About the Author

Director of Product Marketing at ClarionDoor

Spiro started his career as a software engineer, developing and managing R&D projects for NASA and Department of Defense in the early 2000’s on artificial intelligent flight control systems and data sciences. He transitioned to the insurance industry where he was the product director for CGI’s Ratabase and policy administration system and later joined ClarionDoor where he is responsible for product and corporate level marketing, industry thought leadership, and supporting the product vision. Spiro is a well respected leader in the insurance industry whose articles have been featured in various media outlets including Insurance Innovation Reporter, ITA Pro, and Insurance Business America.