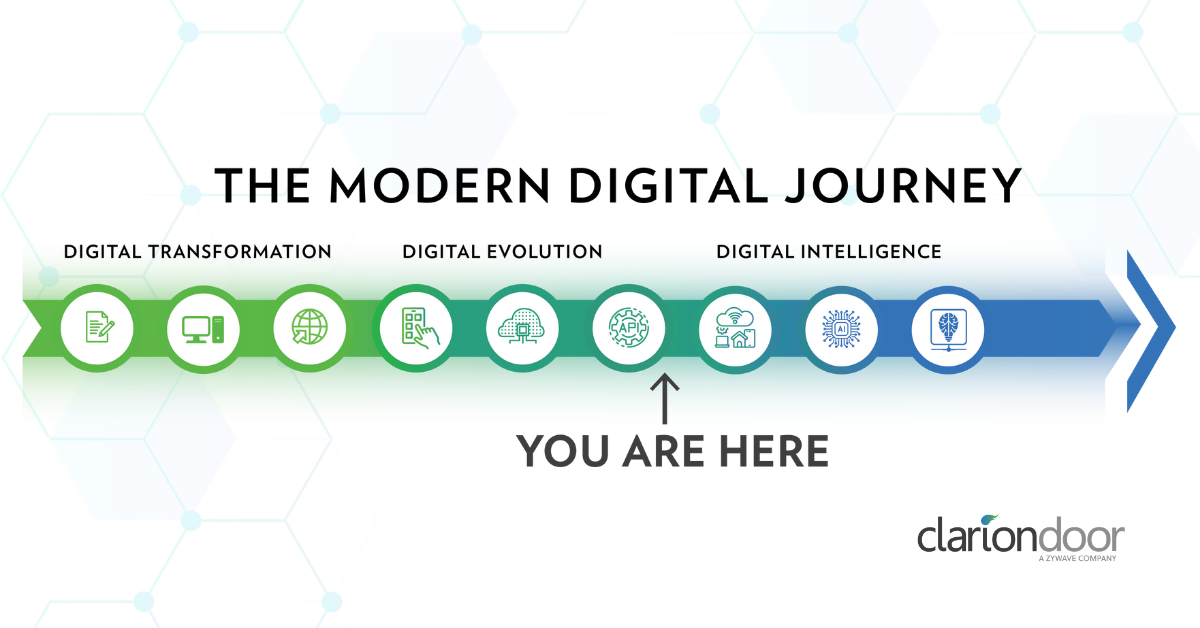

Changing the look of professional liability technology

The ongoing pandemic has had a profound impact on businesses and the “world of work” in general. Many companies have shifted to remote worker/work from home (WFH) employees during the course of the past year, and an even larger number of individuals have chosen to sever ties with traditional corporations in favor of gig economy, on-demand, or entrepreneurial opportunities. This trend has caused an explosion in the need for professional liability coverages, and made it one of the fastest growing sectors in the insurance industry. Today, the professional liability market continues to grow rapidly, but unfortunately, it is also the most neglected from a technology standpoint.